East African Bank Accelerates Smart Loan Disbursement with WSO2

API Management

Overview

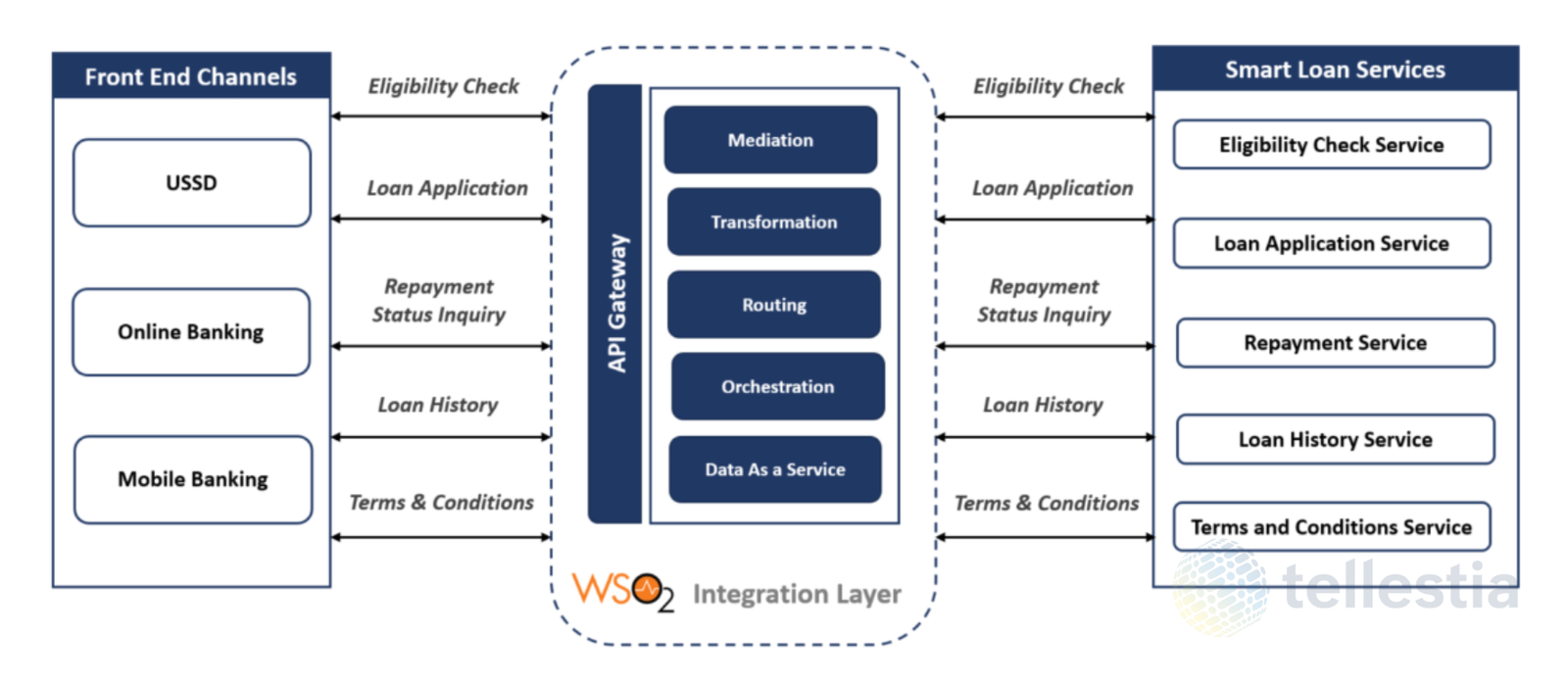

In the modern digital banking landscape, customers demand instant and seamless access to credit services like salary advances. A leading East African bank partnered with Tellestia to modernize its loan disbursement process—eliminating manual inefficiencies and enabling a real-time, secure, and scalable Smart Loan system.

The initiative focused on delivering five core services through a unified API architecture:

- Eligibility Check

- Loan Application

- Repayment Inquiry

- Loan History Inquiry

- Terms of Service Retrieval

By implementing a robust integration layer powered by WSO2 Micro Integrator, the bank transitioned from a branch-based, offline lending model to a fully digital ecosystem - driving faster access to credit, improving customer experience, and enabling operational agility.

The Challenge

Business Challenges

- Delayed Disbursements:

Customers experienced long wait times—ranging from hours to days—for eligibility checks and loan approvals, primarily due to manual back-office processes. - High Support Overhead:

Loan-related queries such as repayment status, history, and terms were handled via call centers, increasing operational burden. - Poor User Experience:

Lack of real-time feedback and confirmation led to customer dissatisfaction and drop-offs during the loan journey.

Technical Challenges

- Decentralized Service Flows:

Each salary advance service was developed independently, resulting in redundant logic, siloed integrations, and higher maintenance costs. - Inconsistent Validations:

Input parameters and account validation processes varied across services, causing silent failures and hard-to-trace errors. - Lack of Observability:

Minimal logging and absence of trace-level monitoring made it difficult to debug issues or track transaction paths.

The Objective

The bank aimed to:

- Streamline and automate the salary advance loan journey from eligibility to repayment.

- Replace fragmented processes with a centralized integration layer.

- Deliver instant, self-service access to Smart Loan services across digital channels.

- Ensure secure, validated, and auditable interactions for all stakeholders.

The Solution

Tellestia designed and implemented a centralized integration layer using WSO2 Micro Integrator (MI), positioned behind an API Gateway to manage all Smart Loan services with consistency, reliability, and performance.

Key Solution Components:

- API Gateway Layer

Handles OAuth 2.0 token validation to ensure secure access before routing requests to the WSO2 MI layer. - Centralized Request Handler (MI)

- Manages metadata, logging, and validation across all service flows.

- Acts as a unified mediation engine that dynamically routes requests to the relevant Smart Loan APIs.

- Input & Account Validation

- Validates mandatory fields such as mobile number, account number, and channel ID.

- Invokes Account Details API to ensure user credentials are valid before progressing.

- Returns precise error messages on validation failure to enhance transparency.

- Smart Loan API Orchestration

- Processes all five services—eligibility check, application, repayment, history, and terms—via optimized, reusable flows.

- Consistent Response Handling

- Formats structured responses across all digital channels, improving clarity and user experience.

The Impact

The implementation of the WSO2-based Smart Loan integration layer delivered measurable improvements across multiple dimensions:

| Metric | Before Implementation | After WSO2 Integration |

|---|---|---|

| Eligibility Check Response Time | 1–2 hours (manual) | <3 seconds (real-time via API) |

| Loan Application Processing | Manual submission via branches | Automated, API-driven process |

| Repayment & History Inquiry | Call center or batch-based | Instant, self-service APIs |

| Validation Consistency | Inconsistent and error-prone | Standardized and centralized |

| Error Reporting | Vague or missing messages | Clear fault codes and explanations |

| System Logging & Traceability | Minimal visibility | Full observability with metadata logging |

| Customer Satisfaction | Low, due to delays and manual effort | High, with real-time, digital access |

| Operational Efficiency | High support team dependency | Significant reduction in manual workload |

Conclusion

The Smart Loan initiative stands as a testament to the transformative power of API-led integration in digital banking. With WSO2 MI at its core, Tellestia enabled the East African bank to deliver fast, secure, and scalable lending services — enhancing customer trust, reducing operational overhead, and laying the groundwork for future-ready digital credit innovations.

Let’s Get Started on Your Transformation Journey.

You Might Also Like

Transforming Payment Infrastructure for a Middle Eastern Bank with Finastra Fusion P2G

A Middle Eastern bank achieved real-time, compliant payments with Finastra P2G and Tellestia’s scalable transformation platform.

Read Story

Automating Claims and Payments through Oracle Health EHR Integration with Insurance Providers

Learn how a leading Dubai healthcare provider automated claims, payments, and pre-authorizations by integrating Oracle Health EHR with UAE insurance...

Read Story

East African Bank Integrates REGIDESO Utility Payments with WSO2

An East African bank streamlines REGIDESO utility payments through real-time WSO2 integration with Tellestia.

Read Story