East African Bank Integrates REGIDESO Utility Payments with WSO2

API Management

Overview

A leading East African bank, known for its digital-first strategy, partnered with REGIDESO—the national electricity and water utility provider in Central Africa—to transform utility bill payments for millions of customers. The bank aimed to provide a seamless, real-time, and integrated payment experience that would eliminate manual processes, reduce service delays, and improve customer satisfaction.

To realize this vision, the bank partnered with Tellestia to design and implement a robust integration layer using WSO2 Micro Integrator. The result: a real-time utility payment ecosystem that connects REGIDESO’s back-end systems with the bank’s digital channels, enabling faster settlements, instant confirmations, and a significantly improved end-user experience.

The Challenge

Business Challenges

REGIDESO’s legacy systems could no longer keep pace with the growing demand and expectations from its diverse customer base. Key challenges included:

- Lack of Instant Payment Confirmation:

Customers using mobile and online banking channels had no real-time confirmation for electricity and water bill payments. This caused confusion, especially among prepaid electricity users, who often experienced disconnection even after paying. - Fragmented Billing Systems:

REGIDESO operated separate billing environments for electricity and water. This complexity made it difficult for the bank to streamline payment journeys or consolidate reconciliation reports. - Delayed Reconciliation:

The bank’s reconciliation with REGIDESO was entirely manual and could take several days—adding operational overhead and delaying financial settlement. - Unstructured Data Exchange:

REGIDESO used a mix of CSV, XML, and flat file formats, requiring the bank to manually transform and normalize data before processing or reporting. - No Real-Time Integration Layer:

Payment files were exchanged using overnight batches with no real-time APIs. This restricted service visibility and created customer service challenges.

Technical Challenges

- Lack of Middleware at the Utility End:

REGIDESO did not have an existing integration layer, meaning the bank had to absorb the complexity of enabling real-time processing. - Data Format Inconsistencies:

Handling multi-format messages from REGIDESO added complexity to data transformation and validation logic on the bank’s side. - Scalability Concerns:

Peak-period loads—especially around billing due dates—strained the systems, causing performance degradation.

The Objective

The bank set out to deliver:

- A real-time utility payment infrastructure that works across digital and branch channels.

- Secure and scalable APIs for seamless integration with REGIDESO’s systems.

- Faster reconciliation and reduced back-office load, enabling operational efficiency.

- Improved customer trust, with instant transaction status visibility and fewer disputes.

The Solution

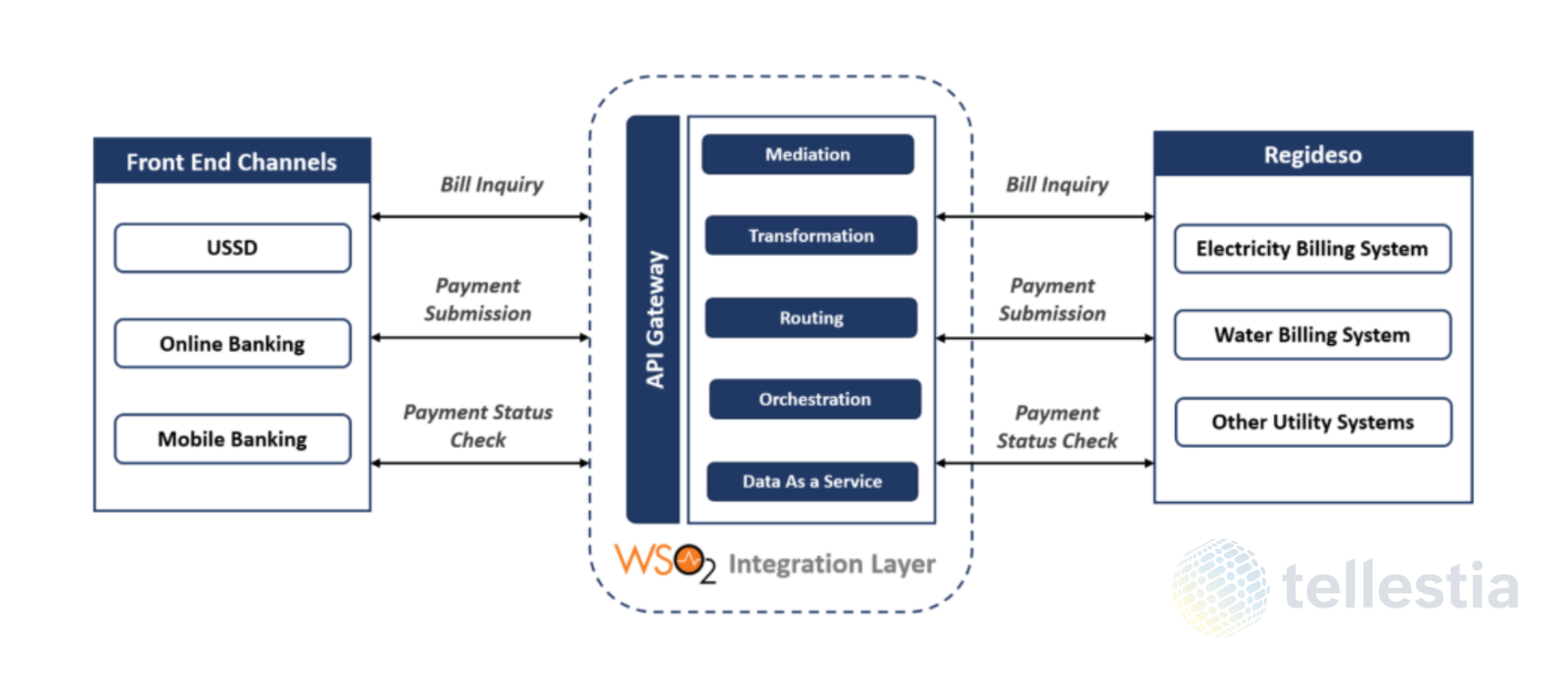

Tellestia worked closely with the bank’s technology and operations teams to architect and implement a modern API-driven integration solution using WSO2 Micro Integrator (MI). The solution acted as the intermediary between the bank’s digital services and REGIDESO’s billing systems.

Key Solution Highlights:

- Central Integration Layer

WSO2 MI served as the core engine to mediate, orchestrate, and transform data between the bank and REGIDESO. - API Gateway for Real-time Services

A set of secure, well-defined APIs were built to handle:- Utility bill inquiry (electricity and water)

- Instant payment confirmation

- Payment status lookups

- Settlement and reversal notifications

- Multi-Format Message Transformation

REGIDESO’s various formats (CSV, XML, JSON) were normalized to a canonical data model—simplifying downstream processing and reconciliation. - Hybrid Channel Support

- Push APIs for real-time interactions via online banking, mobile apps, and agent networks.

- SFTP integration for batch-based offline channels and overnight settlement reports.

- Real-Time Monitoring Dashboards

Custom dashboards enabled operations teams to track transaction success rates, system performance, and reconciliation status in real time. - Built-In Resilience & Compliance

The solution included robust logging, retry mechanisms, and audit trails—ensuring traceability and regulatory alignment.

The Impact

The implementation delivered significant value to the bank, its customers, and REGIDESO.

| Metric | Before Implementation | After WSO2 Integration |

|---|---|---|

| Payment Processing Time | 24–72 hours (manual updates) | Real-time (within seconds) via secure APIs |

| Customer Payment Visibility | Delayed; no confirmation at point of payment | Instant visibility for customers and call center staff |

| Reconciliation Cycle | Manual; error-prone; delays of several days | Automated, near real-time reconciliation |

| Data Consistency | Multiple formats, prone to mismatches | Canonical data model enabled standardized processing |

| Bank–REGIDESO Integration | File-based; offline confirmation | Real-time API and batch support across all channels |

| Peak Load Performance | Limited scalability; frequent slowdowns | Scalable platform with high availability |

| Operational Effort | High manual workload for operations and reconciliation | Reduced by 35–40% with automation |

| Audit & Traceability | Fragmented logs, no unified visibility | Full audit trails, retry logic, and system monitoring |

Additional Outcomes:

- Enhanced Customer Experience: Customers received instant confirmations, reducing service disruptions and increasing trust in the bank’s digital channels.

- Improved Liquidity Management: REGIDESO gained real-time insight into incoming payments, improving financial control and planning.

- Regulatory Readiness: The bank could confidently meet compliance needs with centralized logging and audit-ready integration flows.

- Scalable for Future Growth: The solution laid the foundation for onboarding additional utility partners, adding services, and expanding to other regional markets.

Let’s Get Started on Your Transformation Journey.

You Might Also Like

Fueling Government Innovation with MuleSoft-Powered Digital Integration

A leading public sector entity recognized the need to address functional silos, data duplication, and interoperability challenges to improve operational...

Read Story

Oracle Health EHR Integration with Microsoft Dynamics 365 ERP

Facing delays in billing and inefficient inventory management, a healthcare provider needed to connect its Oracle Health EHR with its...

Read Story

East African Bank Accelerates Smart Loan Disbursement with WSO2

A leading East African bank partners with Tellestia to enable real-time Smart Loan services using WSO2 Micro Integrator.

Read Story