East African Bank Accelerates Smart Loan Disbursement with WSO2

API Management

Overview

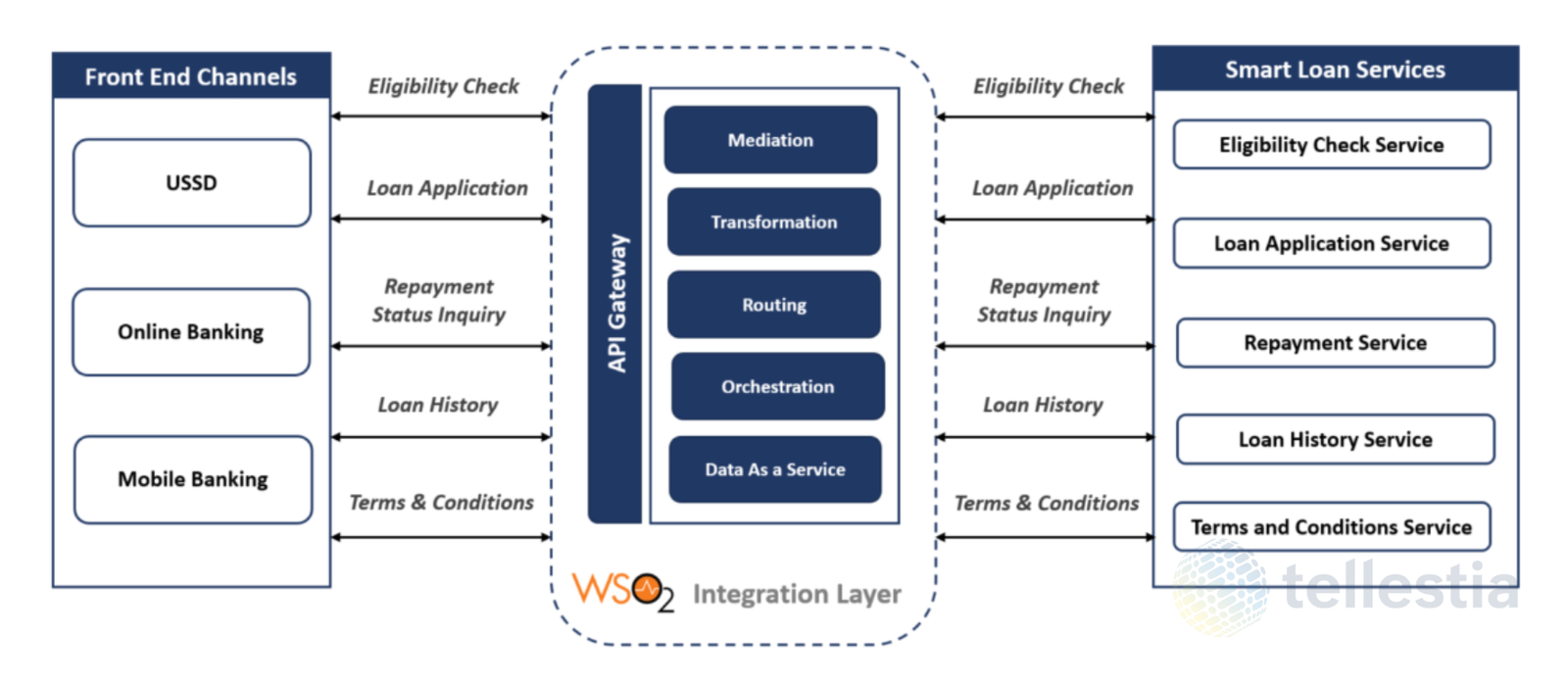

In the modern digital banking landscape, customers demand instant and seamless access to credit services like salary advances. A leading East African bank partnered with Tellestia to modernize its loan disbursement process—eliminating manual inefficiencies and enabling a real-time, secure, and scalable Smart Loan system.

The initiative focused on delivering five core services through a unified API architecture:

- Eligibility Check

- Loan Application

- Repayment Inquiry

- Loan History Inquiry

- Terms of Service Retrieval

By implementing a robust integration layer powered by WSO2 Micro Integrator, the bank transitioned from a branch-based, offline lending model to a fully digital ecosystem - driving faster access to credit, improving customer experience, and enabling operational agility.

The Challenge

Business Challenges

- Delayed Disbursements:

Customers experienced long wait times—ranging from hours to days—for eligibility checks and loan approvals, primarily due to manual back-office processes. - High Support Overhead:

Loan-related queries such as repayment status, history, and terms were handled via call centers, increasing operational burden. - Poor User Experience:

Lack of real-time feedback and confirmation led to customer dissatisfaction and drop-offs during the loan journey.

Technical Challenges

- Decentralized Service Flows:

Each salary advance service was developed independently, resulting in redundant logic, siloed integrations, and higher maintenance costs. - Inconsistent Validations:

Input parameters and account validation processes varied across services, causing silent failures and hard-to-trace errors. - Lack of Observability:

Minimal logging and absence of trace-level monitoring made it difficult to debug issues or track transaction paths.

The Objective

The bank aimed to:

- Streamline and automate the salary advance loan journey from eligibility to repayment.

- Replace fragmented processes with a centralized integration layer.

- Deliver instant, self-service access to Smart Loan services across digital channels.

- Ensure secure, validated, and auditable interactions for all stakeholders.

The Solution

Tellestia designed and implemented a centralized integration layer using WSO2 Micro Integrator (MI), positioned behind an API Gateway to manage all Smart Loan services with consistency, reliability, and performance.

Key Solution Components:

- API Gateway Layer

Handles OAuth 2.0 token validation to ensure secure access before routing requests to the WSO2 MI layer. - Centralized Request Handler (MI)

- Manages metadata, logging, and validation across all service flows.

- Acts as a unified mediation engine that dynamically routes requests to the relevant Smart Loan APIs.

- Input & Account Validation

- Validates mandatory fields such as mobile number, account number, and channel ID.

- Invokes Account Details API to ensure user credentials are valid before progressing.

- Returns precise error messages on validation failure to enhance transparency.

- Smart Loan API Orchestration

- Processes all five services—eligibility check, application, repayment, history, and terms—via optimized, reusable flows.

- Consistent Response Handling

- Formats structured responses across all digital channels, improving clarity and user experience.

The Impact

The implementation of the WSO2-based Smart Loan integration layer delivered measurable improvements across multiple dimensions:

| Metric | Before Implementation | After WSO2 Integration |

|---|---|---|

| Eligibility Check Response Time | 1–2 hours (manual) | <3 seconds (real-time via API) |

| Loan Application Processing | Manual submission via branches | Automated, API-driven process |

| Repayment & History Inquiry | Call center or batch-based | Instant, self-service APIs |

| Validation Consistency | Inconsistent and error-prone | Standardized and centralized |

| Error Reporting | Vague or missing messages | Clear fault codes and explanations |

| System Logging & Traceability | Minimal visibility | Full observability with metadata logging |

| Customer Satisfaction | Low, due to delays and manual effort | High, with real-time, digital access |

| Operational Efficiency | High support team dependency | Significant reduction in manual workload |

Conclusion

The Smart Loan initiative stands as a testament to the transformative power of API-led integration in digital banking. With WSO2 MI at its core, Tellestia enabled the East African bank to deliver fast, secure, and scalable lending services — enhancing customer trust, reducing operational overhead, and laying the groundwork for future-ready digital credit innovations.

Let’s Get Started on Your Transformation Journey.

You Might Also Like

East African Bank Integrates REGIDESO Utility Payments with WSO2

An East African bank streamlines REGIDESO utility payments through real-time WSO2 integration with Tellestia.

Read Story

Automating Claims and Payments through Oracle Health EHR Integration with Insurance Providers

Learn how a leading Dubai healthcare provider automated claims, payments, and pre-authorizations by integrating Oracle Health EHR with UAE insurance...

Read Story

Transforming Insurance Operations with Salesforce and WSO2 Integration in the Middle East

A leading insurance provider in the Middle East, our client serves individuals, businesses, and government entities with a comprehensive portfolio...

Read Story