Transforming Payment Infrastructure for a Middle Eastern Bank with Finastra Fusion P2G

API Management

Overview

A mid-tier bank headquartered in the Middle East, with operations across five countries, sought to modernize its fragmented payment infrastructure. Struggling with outdated legacy systems, slow settlements, and limited real-time capabilities, the bank engaged Tellestia to overhaul its payment ecosystem. The goal: build a scalable, API-driven, ISO 20022-compliant platform powered by Finastra Fusion Payments To Go (P2G) to support real-time and cross-border payments, streamline integration, and drive compliance readiness.

The Challenge

The bank faced a series of critical challenges that hindered operational efficiency, customer experience, and regulatory compliance.

Business Challenges

- Lack of real-time payment capabilities, delaying transactions like Fedwire in the U.S.

- Inability to scale payments business due to legacy systems and slow settlement cycles (2–5 days).

- Regulatory pressure to adopt ISO 20022 and adhere to global compliance standards.

- High operational costs and poor visibility into payment statuses.

Technical Challenges

- Outdated, batch-based processing infrastructure with high maintenance overhead.

- Poor integration capabilities with fintech partners and payment service providers.

- Disjointed testing processes across functional systems.

- Difficulty handling diverse communication protocols (SFTP, JSON, XML, EDI).

- High technical debt and administrative complexity.

The Objective

To future-proof the payment ecosystem by:

- Implementing a cloud-native, API-first payment processing platform.

- Enabling real-time and cross-border payments with minimal latency.

- Achieving seamless integration with the bank's core banking system, channels, and third-party partners.

- Ensuring full compliance with ISO 20022 and emerging global standards.

- Building an architecture that supports scalability, observability, and operational efficiency.

The Solution

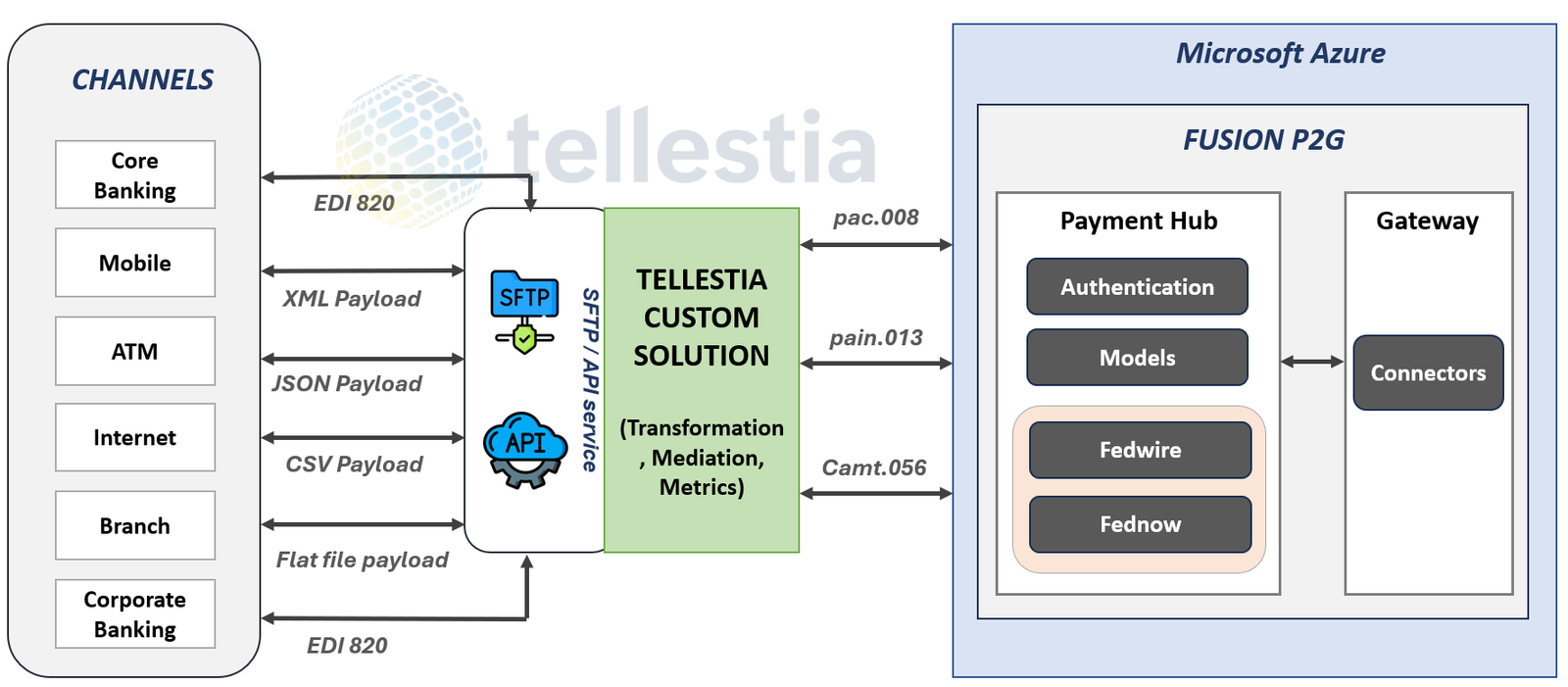

Tellestia designed and implemented a tailored mediation and transformation platform using Finastra Fusion Payments To Go (P2G), enabling the bank to process payments with greater speed, accuracy, and resilience.

Tellestia played a critical role in the success of this payments transformation initiative by delivering value in two key areas:

- Modern Payment Processing Platform

Tellestia recommended the adoption of the Finastra Fusion Payments To Go (P2G) platform, which offered seamless connectivity to FedNow and FedWire networks. This platform was selected for its ability to meet the bank’s modernization and compliance goals, with features including:- Cloud-native architecture – Reduced infrastructure and operational costs.

- API-first design – Enabled effortless integration with third-party fintechs and payment service providers.

- Built-in compliance – Natively supported ISO 20022, PSD2, and SWIFT GPI standards for regulatory alignment.

- Implementation of a Customized Integration & Transformation Layer

In parallel with the platform recommendation, Tellestia developed a tailored mediation solution to ensure seamless integration across the bank’s payment infrastructure. The key components included:- Versatile backend application – Supported file-based push/pull mechanisms via SFTP and APIs.

- Dynamic transformation layer – Automatically converted incoming payment requests from various standards (JSON, XML, EDIFACT – EDI 820/997) into ISO 20022-compliant formats such as pac.008, pain.013, and camt.056.

- Canonical data model – Enabled standardisation and consistency across all payment payloads regardless of source.

- Real-time monitoring and analytics – Provided a centralized dashboard for tracking payment transactions, with a focus on identifying and resolving failed payments.

- Scalable architecture – Designed for both horizontal and vertical scaling to accommodate future growth and volume surges.

- Resilient processing through message brokering – Integrated a robust message broker within the transformation layer to guarantee zero transaction loss. This also enabled reprocessing in case of failures, ensuring end-to-end reliability and peace of mind for the bank and its customers.

The Impact

The transformation delivered substantial business and operational value:

| Metric | Before P2G | After P2G |

|---|---|---|

| Payment Processing Time | 24–48 hours | Real-time (seconds) |

| Transaction Failure Rate | 5% | <0.5% |

| Operational Costs | High (legacy maintenance) | Reduced by 40% |

| Compliance Adherence | Manual updates | Automated ISO 20022 compliance |

| Third-Party Integrations | Limited | Seamless via APIs |

- Enhanced Customer Experience: Real-time payments significantly improved customer satisfaction.

- Future-Proof Architecture: Ready for schemes like FedNow, Fedwire, and SEPA Instant.

- Fraud Risk Reduction: Embedded AI/ML models helped detect anomalies and reduce fraud exposure.

Let’s Get Started on Your Transformation Journey.

You Might Also Like

Enabling Agile Real Estate Operations through Enterprise-Grade iPaaS Integration

A leading UAE-based real estate developer partnered with Tellestia to modernize its IT infrastructure through a scalable, secure, and efficient...

Read Story

Transforming Patient-Centric Care with Real-Time Data Integration for a Leading Saudi Healthcare Provider

Our client, a prominent multi-disciplinary hospital in Saudi Arabia, sought to redefine patient experience and operational efficiency as part of...

Read Story

30% Downtime Reduction with Seamless E-Commerce Application Integration for Enhanced Customer Experience

Faced with rapid growth and increasing technological complexity, a leading e-commerce platform encountered challenges stemming from isolated systems and fragmented...

Read Story